Menu

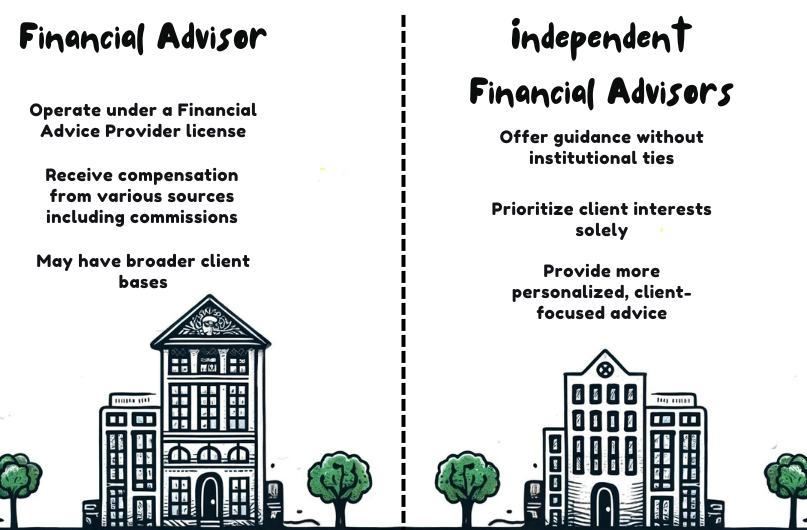

The primary difference between a financial advisor and an independent financial advisor lies in their affiliations and compensation methods. A financial advisor works under a Financial Advice Provider (FAP) license and may be tied to specific financial institutions, influencing the scope of advice they offer. Conversely, an independent financial advisor operates without external ties to institutions, focusing solely on your interests. This independence allows for a broader range of investment options and more personalized financial solutions. Given this distinction, you’ll want to take into account alignment with your financial goals when selecting the type of advisor you need. Choosing wisely can greatly impact your financial strategy’s effectiveness.

A financial advisor is a professional who offers expert advice on managing your finances, including investments, insurance, and planning for future financial needs. As you navigate the complexities of wealth management, a financial advisor serves as your strategic partner, ensuring your financial assets and resources are optimized for both current and future benefits.

In New Zealand, financial advisors must be well-qualified, typically holding a New Zealand Certificate in Financial Services. This certification equips them with the necessary skills in various specializations like investment, insurance, or property lending. Additionally, they’re required to operate under a Financial Advice Provider (FAP) license, guaranteeing they meet stringent regulatory standards.

Your financial advisor, acting as a financial planner, will guide you through investment strategies tailored to your risk tolerance and financial objectives. Retirement planning is another critical area where they provide insight, helping you secure a stable financial future. Moreover, they assist in tax planning, ensuring you benefit from any available tax advantages, thereby increasing your savings and investment potential.

Engaging with a financial advisor ensures that every aspect of your financial life is considered, from building wealth through strategic investments to planning for your retirement and managing your tax liabilities effectively.

While general financial advisors offer a broad range of services, Independent Financial Advisors provide specialized guidance without any institutional ties. As someone seeking mastery in understanding financial advisory services, it’s imperative to grasp the subtleties of an Independent Financial Advisor (IFA).

IFAs epitomize advisory independence, ensuring that their recommendations are aligned solely with your interests, not dictated by any external corporate agenda. This autonomy is vital for unbiased, tailored financial planning. The compensation structure of IFAs also supports their objectivity. They’re remunerated through a mix of fees for service and commissions on products they recommend, which helps mitigate conflicts of interest inherent in commission-only models.

Their primary commitment is to provide client-focused advice, ensuring that strategies developed are personalized and conducive to your financial goals. Here are key aspects that underline the operations of IFAs:

Understanding these elements helps you appreciate the distinct value IFAs bring to your financial planning journey.

Understanding the key differences between Financial Advisors and Independent Financial Advisors is crucial for making informed decisions about your financial planning needs.

First, consider the varied fee structures. Financial Advisors often earn through incentives and commissions linked to the products endorsed by their affiliated institutions. Conversely, Independent Financial Advisors typically blend fees with commissions, focusing more on a structure that aligns with your interests rather than those of a particular financial institution.

Moreover, client focus is notably distinct. Independent Financial Advisors prioritize advice that serves your best interests, steering clear of high-fee, sales-driven products. Conversely, Financial Advisors might push products that favor their employer’s agenda, potentially leading to a conflict of interest. This is a critical consideration as such conflicts can affect the impartiality of the advice you receive.

Both types of advisors must adhere to strict regulatory requirements, including obtaining a Financial Advice Provider (FAP) license in New Zealand, ensuring they meet professional standards. However, the independence of Independent Financial Advisors allows for a broader range of investment options, providing you with tailored solutions that conventional Financial Advisors tied to specific institutions may not offer.

You should consider consulting a Financial Advisor in New Zealand when facing intricate financial decisions or planning needs. These professionals are equipped to guide you through various financial landscapes, ensuring that your strategies are both sound and effectively aligned with your overall objectives.

Key situations where a Financial Advisor’s expertise is invaluable include:

Addressing these areas with a Financial Advisor ensures that your decisions are informed and your plans are robust. This support is vital, particularly when you aim to build a detailed financial plan that encompasses both your short-term and long-term aspirations. Whether you’re just starting out or looking to refine your existing financial strategies, the insights from a seasoned Financial Advisor can prove invaluable in navigating the complexities of financial planning and achieving your financial goals.

Considering an Independent Financial Advisor becomes essential when you need specialized, unbiased financial guidance tailored to your unique circumstances. If you’re managing significant life decisions such as purchasing your first home, investing in real estate, or planning business finances, the personalized guidance from an Independent Financial Advisor ensures that your strategies are precisely aligned with your objectives. They’re dedicated to offering tailored solutions that resonate with your personal and financial aspirations.

Achieving financial independence requires clear, objective advice that only an Independent Financial Advisor can consistently provide. They stand apart by prioritizing your interests without the sway of affiliations to specific financial institutions or products. This level of integrity in counsel is vital, especially when you’re aiming to meet intricate financial goals.

Moreover, if you’re seeking all-encompassing support that covers all aspects of your financial life—from mortgage planning to property investment and beyond—an Independent Financial Advisor can deliver a holistic approach. Their expertise, possibly enriched by a global perspective, can greatly improve the quality of the financial strategies devised for you.

In essence, when your financial situations demand more than generic advice, turning to an Independent Financial Advisor in New Zealand is a prudent choice to ensure that your financial plans are both ambitious and achievable.

When selecting a financial advisor, it’s important to verify their qualifications and certifications to make sure they meet industry standards. This step is vital not only for regulatory compliance but also to ensure that you’re receiving professional and competent advice tailored to your financial needs.

Both financial advisors and independent financial advisors in New Zealand must hold the New Zealand Certificate in Financial Services (Level 5). This certificate ensures that they’ve undergone rigorous training programs and adhere to the certification requirements set forth by the industry. Additionally, independent financial advisors need a Financial Advice Provider (FAP) license, enhancing their credibility and commitment to providing unbiased advice.

Here are key qualifications and certifications to look for:

These credentials are pivotal in the professional development of advisors and are benchmarks of their dedication to upholding industry standards.

In New Zealand, both financial advisors and independent financial advisors are closely monitored to guarantee they meet stringent competency and ethical standards. They must adhere to a thorough regulatory framework designed to uphold the integrity of financial advice provided to you. The licensing process is a critical component of this framework, requiring advisors to either hold or operate under a Financial Advice Provider (FAP) license. This guarantees that the advice you receive aligns with both national standards and your personal financial goals.

Compliance standards are rigorously enforced by the Financial Markets Authority (FMA), which mandates that all advisors demonstrate competence equivalent to the New Zealand Certificate in Financial Services (Level 5). Additionally, adherence to a Code of Professional Conduct is compulsory, emphasizing ethical obligations and the prioritization of client interests. This code dictates that advisors must act with care, diligence, and skill, ensuring that your interests are always at the forefront of their advice.

Whether you engage a financial advisor or an independent financial advisor, you can be confident that both are subjected to the same regulatory requirements, designed to protect and maximize your financial well-being.

To select the right financial advisor, it’s important to ask several key questions that can help determine their qualifications, independence, and alignment with your financial goals. Understanding the depth of an advisor’s qualifications, their approach to advisory services, and their commitment to client relationships can greatly impact your satisfaction and success in achieving your financial objectives.

Here are critical questions you should consider in your advisor selection process:

Finding and vetting potential advisors necessitates careful examination of their qualifications, independence, and compensation methods to guarantee they align with your financial interests. The advisor selection process begins with a thorough credentials check. Confirm that the advisor holds the New Zealand Certificate in Financial Services (Level 5) or higher, and verify their licensing as a Financial Advice Provider (FAP) or under another FAP’s license.

During the vetting process, assess their independence criteria. Make sure they aren’t affiliated with any financial institutions which could bias their recommendations. Independent financial advisors, free from such ties, are better positioned to prioritize your best interests without the influence of external pressures.

Also, scrutinize their compensation structure. Opt for advisors who are compensated through a fee-only model rather than those who earn commissions on products they sell. This minimizes potential conflicts of interest and aligns their incentives with your financial success.

Once you’ve selected a financial advisor, it’s essential to establish a productive working relationship to effectively manage your financial future. Building trust and maintaining effective communication are foundational to this relationship. Being transparent about your financial situation and goals allows your advisor to develop tailored investment strategies and risk management plans that align with your aspirations.

To make the most of your relationship with your financial advisor, consider these practical steps:

You may find that independent financial advisors offer more competitive rates due to varied fee structures, higher advisor accessibility, customized services, distinct regulatory differences, and a focus on client exclusivity compared to larger firms.

Yes, financial advisors are essential for young adults to master early savings importance, budgeting strategies, career financial planning, debt management tips, and investment basics education, setting a solid foundation for financial success.

Working with a financial advisor can affect your taxes through advisor fees, investment taxes, and possible tax deductions. They assist with filing and improve record keeping, which can optimize your financial returns.

Financial advisors’ compensation varies; they may earn through fee structures, commissions, or a mix. High ethical standards and meeting performance benchmarks aid in client retention, avoiding commission conflicts and ensuring compliance.

You’ll find that online financial advisory services offer geographic flexibility, tech integration, and digital literacy advantages. However, they might lag in service customization and client confidentiality compared to face-to-face consultations.

To sum up, whether you choose a financial advisor or an independent financial advisor, it’s important to evaluate your financial needs and goals. Both types of advisors are regulated in NZ to guarantee they meet stringent standards, but their affiliations might influence their recommendations.

Always ask the right questions and thoroughly vet potential advisors. Building a transparent, communicative relationship will help you make the most of their expertise to achieve your financial objectives.