Menu

Estate planning is a vital aspect of financial planning that is often overlooked or delayed. However, it is an essential process that ensures your assets are distributed according to your wishes after your death and provides security for your loved ones. Estate planning is not just for the wealthy; it is for anyone who wants to make sure their wishes are carried out, avoid unnecessary costs, and ensure their family’s financial stability.

In New Zealand, the process of estate planning can seem overwhelming, especially with legal documents, tax implications, and family dynamics to consider. In this blog post, we’ll walk you through the key aspects of estate planning, what you need to do to get started, and how a financial advisor can help you navigate this crucial part of your financial journey.

What Is Estate Planning?

At its core, estate planning is the process of arranging for the distribution of your assets after you pass away. It involves deciding who will inherit your property, how your debts will be settled, and who will make important decisions about your healthcare and finances if you’re unable to make those decisions yourself.

Estate planning is designed to ensure that your assets are distributed in a way that reflects your wishes and minimizes complications for your family. Without proper planning, your estate may be subject to unnecessary taxes, legal battles, and delays in distribution.

Key Components of Estate Planning

Estate planning can involve a variety of documents, tools, and decisions. Here are the key components to consider:

A will is the cornerstone of any estate plan. It is a legal document that outlines how your assets will be distributed after your death. In New Zealand, a will allows you to name an executor (someone who will manage your estate) and specify who will inherit your property, including any real estate, savings, investments, and personal belongings.

Your will should also specify guardians for any minor children and state your preferences for funeral arrangements. It’s crucial to ensure that your will is clear, up to date, and legally valid. Consulting with a financial advisor or lawyer can help ensure your will reflects your true wishes.

A trust is a legal arrangement where you place assets under the control of a trustee for the benefit of your chosen beneficiaries. There are different types of trusts, such as family trusts, which are popular in New Zealand, and can help manage your assets in a way that may minimize taxes and provide for future generations.

A trust is especially useful if you want to protect your assets from creditors, ensure a more streamlined inheritance process, or have specific requirements for how your assets should be used. A trust can be revocable or irrevocable, depending on your needs.

A power of attorney (POA) is a legal document that gives someone you trust the authority to make decisions on your behalf if you become incapacitated. There are two types of POA: a general POA and an enduring POA. A general POA covers financial decisions, while an enduring POA allows someone to make decisions about your healthcare and welfare.

In the event that you are unable to manage your affairs due to illness, injury, or old age, your appointed person will be able to make decisions on your behalf, ensuring your wishes are respected. It’s important to choose someone trustworthy and ensure they are willing to take on this responsibility.

In New Zealand, an enduring power of attorney for healthcare decisions allows you to appoint someone to make decisions regarding your health and medical treatment if you are no longer able to do so. This document is vital to ensure that someone you trust can advocate for your health and well-being in case of incapacity.

One of the most important aspects of estate planning is determining who will inherit your assets. This can include your spouse, children, grandchildren, or other family members, as well as friends, charities, or organizations. It’s important to consider who should receive specific items or sums of money, as well as how you want your estate to be divided.

Naming clear beneficiaries in your will or trust can help minimize confusion and prevent potential conflicts among your heirs.

While not technically part of the distribution of your estate, specifying your funeral wishes can relieve your family of stress and confusion during an already difficult time. You can include instructions for your funeral service, burial, cremation, and memorials.

Having a pre-paid funeral plan can also be part of your estate planning process, allowing you to secure your funeral arrangements in advance, which can ease the financial burden on your loved ones.

Tax planning is a crucial part of estate planning. In New Zealand, the government does not impose an inheritance or estate tax, which can benefit your heirs. However, some tax considerations may still apply, such as income tax on investments or property.

Proper estate planning ensures that your heirs are aware of any tax obligations and can help reduce the overall tax burden by strategically structuring your estate. A financial advisor can help you understand potential tax implications and guide you through options such as gifting or using a trust.

Why Estate Planning is Important in New Zealand

Estate planning is critical for a number of reasons, especially in New Zealand, where assets like real estate can be significant, and family dynamics are varied. Some reasons why estate planning is important include:

How to Get Started with Estate Planning

Estate planning can seem overwhelming, but it doesn’t have to be. Here are the steps to get started:

Conclusion: Protect Your Legacy with Estate Planning

Estate planning is an essential process that provides peace of mind, financial security for your loved ones, and ensures your wishes are respected. By taking the time to plan your estate properly, you can minimize confusion, reduce costs, and ensure that your family is taken care of after your passing.

At Best Financial Advisors, we understand the importance of estate planning and are here to guide you through every step of the process. Our team of experts can help you create a comprehensive estate plan that aligns with your goals and ensures your legacy is protected.

Don’t wait—start your estate planning today. Contact Best Financial Advisors for personalized advice and guidance on creating a solid estate plan. Your family’s future is worth it. Reach out to us now and take the first step towards securing your legacy.

Taking control of your finances is one of the most important steps towards financial independence and peace of mind. Whether you’re planning for your future, saving for a big purchase, or simply trying to make ends meet, budgeting plays a crucial role in managing your money effectively. In this blog post, we’ll walk you through the basics of budgeting, why it’s essential, and how you can start budgeting today to take control of your financial situation.

Budgeting is the process of creating a plan to manage your income and expenses. It allows you to track where your money is coming from and where it is going, helping you prioritize spending, save money, and plan for the future. The goal of budgeting is to ensure that you are spending money in a way that aligns with your financial priorities, while also ensuring you have enough for savings and unexpected expenses.

Budgeting doesn’t have to be complicated. With a few simple steps, you can create a budget that works for you. Here’s how to get started:

Before you can start budgeting, you need to know where you stand financially. Look at your income, debt, expenses, and savings. This will give you a clear picture of your financial health.

Once you understand your financial situation, set clear goals for your budget. These goals can be short-term (e.g., paying off a credit card) or long-term (e.g., saving for a home or retirement). Setting goals helps you stay motivated and focused on what you want to achieve with your money.

There are several methods for creating a budget. The right method for you depends on your preferences and goals. Some of the most popular budgeting methods include:

Once you’ve set up your budget, it’s important to track your spending regularly. You can do this manually by keeping receipts and recording expenses, or you can use budgeting apps like YNAB (You Need A Budget), Mint, or PocketGuard to track everything automatically.

Tracking helps you stay on top of your budget and make adjustments if necessary. If you’re spending more than you planned in one category, you can reduce spending in other areas to compensate.

To stick to your budget, you may need to make some lifestyle adjustments. Look for areas where you can reduce spending, such as:

Reducing unnecessary spending will free up more money for savings and help you reach your financial goals faster.

A budget is not a one-time thing. Your financial situation will change over time, so it’s essential to review and adjust your budget regularly. For example, if you get a raise or have a large unexpected expense, update your budget accordingly.

An emergency fund is essential for covering unexpected expenses, such as medical bills, car repairs, or job loss. Ideally, your emergency fund should cover three to six months’ worth of living expenses. Set aside money each month for this fund, and don’t dip into it unless it’s an emergency.

As a homeowner in New Zealand, budgeting becomes even more important due to the costs associated with owning a property. Here are some specific budgeting tips for homeowners:

Even with the best intentions, budgeting can be tricky. Here are a few common mistakes that homeowners often make:

Budgeting is a powerful tool that helps you take control of your finances, achieve your goals, and avoid unnecessary stress. By understanding your financial situation, setting clear goals, and sticking to a plan, you can take charge of your money and secure a brighter future for yourself and your family.

If you’re looking for personalized financial advice and guidance on budgeting, savings, and achieving your financial goals, contact Best Financial Advisors today. Our expert team is here to help you navigate your financial journey and make informed decisions for your future.

Retirement planning is one of the most important financial decisions you can make, yet it is often overlooked or delayed by many. In New Zealand, the cost of living is steadily rising, and the need for financial security in your later years has never been more crucial. Whether you are in your 20s or nearing retirement age, it’s never too early or too late to start thinking about your retirement goals. With proper planning and the right strategies, you can enjoy your retirement years without financial worry.

In this guide, we’ll break down the essentials of retirement planning for Kiwis and help you get started on the path to a secure and stress-free retirement.

The concept of retirement planning involves setting aside money for the future so you can live comfortably when you’re no longer working. Without proper planning, you could find yourself facing financial uncertainty in your golden years.

In New Zealand, there is a government-funded pension called New Zealand Superannuation (NZ Super) that provides basic income for retirees aged 65 and over. However, it may not be enough to maintain your current lifestyle. On average, NZ Super provides around 65% of the average income, which means you’ll need additional savings to cover living costs, healthcare, travel, and leisure activities.

The sooner you start saving, the more you benefit from compounding growth. Whether through KiwiSaver or private savings, the key is to begin early and take consistent steps toward securing your financial future.

Before diving into saving and investing, it’s important to understand how much money you’ll need in retirement. The first step is to assess your lifestyle and determine the following:

Once you have an estimate of your monthly expenses, you can determine how much you need to save to meet those needs. You can then set clear goals for how much to save and by when.

One of the best retirement saving tools available in New Zealand is KiwiSaver, a government-backed savings scheme that helps New Zealanders save for retirement. KiwiSaver contributions are automatically deducted from your wages, which means you’re regularly contributing to your retirement savings.

Here’s what you need to know about KiwiSaver:

KiwiSaver is a great starting point for retirement savings, but it’s often not enough on its own to provide for a comfortable retirement, especially if you want to retire early or live a more lavish lifestyle. This is where additional savings and investments come into play.

While KiwiSaver is an excellent option, you should also consider additional retirement savings strategies to further enhance your financial security. These could include:

When it comes to saving for retirement, diversification is key. Instead of putting all your savings into one investment type, spread them across a range of assets to reduce risk and improve returns.

Some options to consider for retirement diversification include:

Working with a financial advisor can help you create a diversified portfolio tailored to your needs, time horizon, and risk appetite.

Retirement planning is not a one-time task; it’s a lifelong process. Your financial goals, lifestyle, and market conditions may change, so it’s essential to review your retirement strategy regularly and adjust accordingly.

Retirement planning can be complex, and having expert guidance can make a significant difference. Financial advisors can provide personalized recommendations, help you navigate KiwiSaver, suggest tax-effective strategies, and assist with investment decisions. Whether you are just starting out or are nearing retirement, working with a professional can help you stay on track and maximize your retirement savings.

Retirement planning is a critical aspect of achieving financial freedom and peace of mind in your later years. By starting early, contributing regularly to KiwiSaver, considering additional savings and investments, and seeking expert advice, you can set yourself up for a secure and comfortable retirement.

At Best Financial Advisors, we specialize in helping Kiwis plan for their future. Contact us today for a free consultation and take the first step toward a financially secure retirement.

When it comes to managing your finances, understanding the distinction between saving and investing is crucial for building long-term wealth and ensuring financial security. Both saving and investing play essential roles in a comprehensive financial plan, but they serve different purposes and come with varying levels of risk and reward.

For New Zealanders navigating their financial futures, understanding when to save and when to invest can make all the difference in achieving financial goals. Whether you’re aiming for short-term financial stability or long-term wealth accumulation, learning how to balance these two strategies is key.

In this blog post, we will break down the differences between saving and investing, explore when each strategy is most appropriate, and provide tips on how to implement them effectively in your financial journey.

Saving refers to putting money aside for short-term goals or emergencies. The focus of saving is to accumulate funds in a safe and liquid form, meaning you can access your money whenever you need it. In New Zealand, savings are typically kept in savings accounts, term deposits, or other low-risk financial products that offer a fixed interest rate.

The key characteristics of saving include:

Investing, on the other hand, involves putting your money into assets that have the potential to grow over time. These assets could include stocks, bonds, real estate, or mutual funds, with the aim of achieving a higher return. Investments are typically made with a longer time horizon and come with varying levels of risk depending on the asset type.

Key characteristics of investing include:

To better understand the differences between saving and investing, let’s compare them across several factors:

| Factor | Saving | Investing |

|---|---|---|

| Risk | Low risk, minimal chance of loss | Higher risk, potential for loss |

| Return | Low return (usually interest) | Higher return potential (capital gains, dividends) |

| Liquidity | Highly liquid, easy to access | Varies; some investments may be illiquid for a period of time |

| Purpose | Short-term goals (e.g., emergencies) | Long-term goals (e.g., retirement, wealth building) |

| Time Horizon | Short to medium-term | Long-term focus (5+ years) |

While saving might not offer the same growth potential as investing, it is still an essential component of your financial strategy. Here are the times when saving is most beneficial:

One of the most important reasons to save is to create an emergency fund. Life can be unpredictable, and having money set aside for unexpected expenses like medical bills, car repairs, or job loss is essential. In New Zealand, financial experts recommend having three to six months’ worth of living expenses in an easily accessible savings account.

If you have short-term financial goals, such as purchasing a new car, going on a holiday, or renovating your home, saving is the ideal strategy. Since these goals require immediate access to cash and are less than five years away, putting your money in low-risk savings accounts ensures that your money is available when needed.

For New Zealanders looking to buy a home, saving for a down payment is a top priority. Saving consistently for a home deposit in a secure, low-risk account will help you reach your goal of becoming a homeowner without the stress of market volatility.

While saving is crucial for immediate financial needs, investing is essential for building long-term wealth. Here are some of the best times to consider investing:

Investing is ideal when you have a long-term financial goal in mind, such as retirement or building wealth over the next 10, 20, or 30 years. For instance, in New Zealand, superannuation (the government pension) may not be enough to cover all your living expenses in retirement, so investing in a retirement savings plan is vital to ensure you can maintain your desired lifestyle.

If your goal is to grow your wealth over time, investing can provide the opportunity for greater returns. This is especially important if you want to diversify your financial portfolio and accumulate assets such as stocks, bonds, or property.

Inflation is a reality that erodes the purchasing power of your savings over time. If your savings are only earning a low interest rate, your money may not be keeping up with inflation. Investing in growth-oriented assets, such as stocks or real estate, can help your money grow faster than inflation, allowing you to preserve and increase your wealth.

It’s not always an either-or situation between saving and investing. In fact, the most effective financial strategy typically involves a balance of both. Here’s how you can strike the right balance:

Before diving into investing, it’s crucial to have a solid emergency fund. This safety net ensures that you are financially prepared for unexpected expenses, allowing you to focus on your investment strategy without worrying about unforeseen circumstances.

Defining clear short-term and long-term financial goals will help you determine how much money to allocate to savings versus investments. For example, you may decide to save for a home deposit while also investing for retirement. Prioritizing these goals based on their timeline and importance will help you manage your finances effectively.

Once you’ve built a solid savings foundation, you can begin to explore investment options. Consider working with a financial advisor who can help you assess your risk tolerance, determine an appropriate asset allocation, and choose investment vehicles that align with your financial objectives.

In New Zealand, there are several investment options that can help you grow your wealth over time:

KiwiSaver is a government-backed retirement savings scheme designed to help New Zealanders save for retirement. The scheme offers various investment funds, and your contributions are matched by the government, making it an excellent option for long-term savings.

Real estate investment, either through purchasing property or investing in property funds, can provide strong returns over time, especially in New Zealand’s growing property market.

Investing in the stock market can offer high potential returns, but it also comes with higher risks. New Zealanders can invest in local companies through the NZX or explore international markets for diversification.

Bonds are a more conservative investment option compared to stocks. They offer fixed interest payments over time and are generally less volatile. For those seeking a safer investment, bonds can be a good choice.

Both saving and investing are essential components of a comprehensive financial strategy, and understanding when to use each approach is critical for achieving your financial goals. Saving provides security and liquidity for short-term goals, while investing helps you grow your wealth over the long term.

For New Zealanders, finding the right balance between saving and investing is crucial. Whether you’re looking to save for a home, build an emergency fund, or invest for retirement, a tailored financial strategy can help you achieve your objectives.

Managing your finances can be a daunting task, especially when life brings about significant transitions and milestones. From buying your first home to planning for retirement, financial decisions need to be well thought out and backed by expert knowledge. That’s where a financial advisor comes in. In New Zealand, financial advisors play a crucial role in helping individuals make sound financial decisions that align with their long-term goals and life circumstances.

Whether you’re starting your career, raising a family, or nearing retirement, working with a financial advisor provides numerous benefits. This blog post will delve into why you need a financial advisor at every stage of life and how their expertise can guide you toward financial success.

A financial advisor is a professional who helps you manage your finances by providing expert advice on budgeting, investing, saving for retirement, and more. Their role includes assessing your current financial situation, identifying your goals, and developing a personalized strategy to help you achieve those objectives.

In New Zealand, financial advisors are regulated by the Financial Markets Authority (FMA) and must adhere to strict standards, ensuring that they provide sound and ethical advice to clients.

Financial advisors offer a wide range of services that can be customized based on your financial needs and life goals. Some of the most notable benefits of working with a financial advisor include:

The early years of your career are crucial for building a solid financial foundation. It’s a time when you’re learning how to budget, pay off student loans, and possibly save for a home or starting a family. Working with a financial advisor during this stage can help you set the stage for future financial success.

As you approach your 40s and 50s, your financial situation may become more complex. By now, you may have a family, a mortgage, and perhaps a desire to begin focusing on retirement. This stage of life is all about balancing immediate needs with long-term goals, and a financial advisor can help ensure that you’re on track.

As you near retirement age, the focus shifts to preserving the wealth you’ve worked hard to build and making sure you have a steady income for your retirement years. This stage of life is often about managing risk and ensuring that your assets last through retirement.

Whether you’re in the early stages of your career or nearing retirement, having a financial advisor by your side can make all the difference. At Best Financial Advisors, we are committed to providing expert financial advice that is tailored to your individual needs and goals.

We understand that every stage of life presents unique challenges and opportunities, and we are here to guide you every step of the way. Our team of experienced advisors will work closely with you to develop a comprehensive financial plan, providing clarity and confidence in your financial future.

A financial advisor is more than just someone who helps you manage your money. They are a trusted partner who will help you navigate life’s financial decisions, from saving for a home to planning for retirement. At every stage of life, a financial advisor can help you stay on track, manage risks, and make the best decisions to achieve your financial goals.

If you’re ready to take control of your financial future, contact Best Financial Advisors today. We’re here to provide personalized advice and help you create a financial strategy that works for you. Let’s start planning for your tomorrow, today!

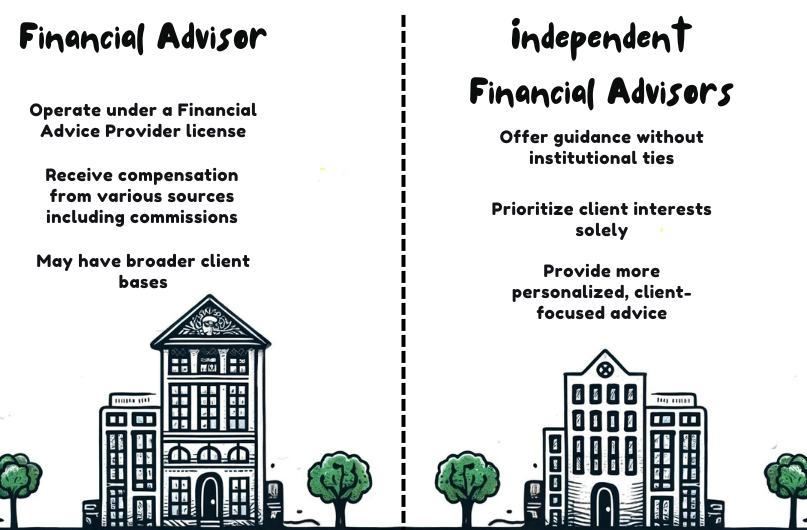

The primary difference between a financial advisor and an independent financial advisor lies in their affiliations and compensation methods. A financial advisor works under a Financial Advice Provider (FAP) license and may be tied to specific financial institutions, influencing the scope of advice they offer. Conversely, an independent financial advisor operates without external ties to institutions, focusing solely on your interests. This independence allows for a broader range of investment options and more personalized financial solutions. Given this distinction, you’ll want to take into account alignment with your financial goals when selecting the type of advisor you need. Choosing wisely can greatly impact your financial strategy’s effectiveness.

A financial advisor is a professional who offers expert advice on managing your finances, including investments, insurance, and planning for future financial needs. As you navigate the complexities of wealth management, a financial advisor serves as your strategic partner, ensuring your financial assets and resources are optimized for both current and future benefits.

In New Zealand, financial advisors must be well-qualified, typically holding a New Zealand Certificate in Financial Services. This certification equips them with the necessary skills in various specializations like investment, insurance, or property lending. Additionally, they’re required to operate under a Financial Advice Provider (FAP) license, guaranteeing they meet stringent regulatory standards.

Your financial advisor, acting as a financial planner, will guide you through investment strategies tailored to your risk tolerance and financial objectives. Retirement planning is another critical area where they provide insight, helping you secure a stable financial future. Moreover, they assist in tax planning, ensuring you benefit from any available tax advantages, thereby increasing your savings and investment potential.

Engaging with a financial advisor ensures that every aspect of your financial life is considered, from building wealth through strategic investments to planning for your retirement and managing your tax liabilities effectively.

While general financial advisors offer a broad range of services, Independent Financial Advisors provide specialized guidance without any institutional ties. As someone seeking mastery in understanding financial advisory services, it’s imperative to grasp the subtleties of an Independent Financial Advisor (IFA).

IFAs epitomize advisory independence, ensuring that their recommendations are aligned solely with your interests, not dictated by any external corporate agenda. This autonomy is vital for unbiased, tailored financial planning. The compensation structure of IFAs also supports their objectivity. They’re remunerated through a mix of fees for service and commissions on products they recommend, which helps mitigate conflicts of interest inherent in commission-only models.

Their primary commitment is to provide client-focused advice, ensuring that strategies developed are personalized and conducive to your financial goals. Here are key aspects that underline the operations of IFAs:

Understanding these elements helps you appreciate the distinct value IFAs bring to your financial planning journey.

Understanding the key differences between Financial Advisors and Independent Financial Advisors is crucial for making informed decisions about your financial planning needs.

First, consider the varied fee structures. Financial Advisors often earn through incentives and commissions linked to the products endorsed by their affiliated institutions. Conversely, Independent Financial Advisors typically blend fees with commissions, focusing more on a structure that aligns with your interests rather than those of a particular financial institution.

Moreover, client focus is notably distinct. Independent Financial Advisors prioritize advice that serves your best interests, steering clear of high-fee, sales-driven products. Conversely, Financial Advisors might push products that favor their employer’s agenda, potentially leading to a conflict of interest. This is a critical consideration as such conflicts can affect the impartiality of the advice you receive.

Both types of advisors must adhere to strict regulatory requirements, including obtaining a Financial Advice Provider (FAP) license in New Zealand, ensuring they meet professional standards. However, the independence of Independent Financial Advisors allows for a broader range of investment options, providing you with tailored solutions that conventional Financial Advisors tied to specific institutions may not offer.

You should consider consulting a Financial Advisor in New Zealand when facing intricate financial decisions or planning needs. These professionals are equipped to guide you through various financial landscapes, ensuring that your strategies are both sound and effectively aligned with your overall objectives.

Key situations where a Financial Advisor’s expertise is invaluable include:

Addressing these areas with a Financial Advisor ensures that your decisions are informed and your plans are robust. This support is vital, particularly when you aim to build a detailed financial plan that encompasses both your short-term and long-term aspirations. Whether you’re just starting out or looking to refine your existing financial strategies, the insights from a seasoned Financial Advisor can prove invaluable in navigating the complexities of financial planning and achieving your financial goals.

Considering an Independent Financial Advisor becomes essential when you need specialized, unbiased financial guidance tailored to your unique circumstances. If you’re managing significant life decisions such as purchasing your first home, investing in real estate, or planning business finances, the personalized guidance from an Independent Financial Advisor ensures that your strategies are precisely aligned with your objectives. They’re dedicated to offering tailored solutions that resonate with your personal and financial aspirations.

Achieving financial independence requires clear, objective advice that only an Independent Financial Advisor can consistently provide. They stand apart by prioritizing your interests without the sway of affiliations to specific financial institutions or products. This level of integrity in counsel is vital, especially when you’re aiming to meet intricate financial goals.

Moreover, if you’re seeking all-encompassing support that covers all aspects of your financial life—from mortgage planning to property investment and beyond—an Independent Financial Advisor can deliver a holistic approach. Their expertise, possibly enriched by a global perspective, can greatly improve the quality of the financial strategies devised for you.

In essence, when your financial situations demand more than generic advice, turning to an Independent Financial Advisor in New Zealand is a prudent choice to ensure that your financial plans are both ambitious and achievable.

When selecting a financial advisor, it’s important to verify their qualifications and certifications to make sure they meet industry standards. This step is vital not only for regulatory compliance but also to ensure that you’re receiving professional and competent advice tailored to your financial needs.

Both financial advisors and independent financial advisors in New Zealand must hold the New Zealand Certificate in Financial Services (Level 5). This certificate ensures that they’ve undergone rigorous training programs and adhere to the certification requirements set forth by the industry. Additionally, independent financial advisors need a Financial Advice Provider (FAP) license, enhancing their credibility and commitment to providing unbiased advice.

Here are key qualifications and certifications to look for:

These credentials are pivotal in the professional development of advisors and are benchmarks of their dedication to upholding industry standards.

In New Zealand, both financial advisors and independent financial advisors are closely monitored to guarantee they meet stringent competency and ethical standards. They must adhere to a thorough regulatory framework designed to uphold the integrity of financial advice provided to you. The licensing process is a critical component of this framework, requiring advisors to either hold or operate under a Financial Advice Provider (FAP) license. This guarantees that the advice you receive aligns with both national standards and your personal financial goals.

Compliance standards are rigorously enforced by the Financial Markets Authority (FMA), which mandates that all advisors demonstrate competence equivalent to the New Zealand Certificate in Financial Services (Level 5). Additionally, adherence to a Code of Professional Conduct is compulsory, emphasizing ethical obligations and the prioritization of client interests. This code dictates that advisors must act with care, diligence, and skill, ensuring that your interests are always at the forefront of their advice.

Whether you engage a financial advisor or an independent financial advisor, you can be confident that both are subjected to the same regulatory requirements, designed to protect and maximize your financial well-being.

To select the right financial advisor, it’s important to ask several key questions that can help determine their qualifications, independence, and alignment with your financial goals. Understanding the depth of an advisor’s qualifications, their approach to advisory services, and their commitment to client relationships can greatly impact your satisfaction and success in achieving your financial objectives.

Here are critical questions you should consider in your advisor selection process:

Finding and vetting potential advisors necessitates careful examination of their qualifications, independence, and compensation methods to guarantee they align with your financial interests. The advisor selection process begins with a thorough credentials check. Confirm that the advisor holds the New Zealand Certificate in Financial Services (Level 5) or higher, and verify their licensing as a Financial Advice Provider (FAP) or under another FAP’s license.

During the vetting process, assess their independence criteria. Make sure they aren’t affiliated with any financial institutions which could bias their recommendations. Independent financial advisors, free from such ties, are better positioned to prioritize your best interests without the influence of external pressures.

Also, scrutinize their compensation structure. Opt for advisors who are compensated through a fee-only model rather than those who earn commissions on products they sell. This minimizes potential conflicts of interest and aligns their incentives with your financial success.

Once you’ve selected a financial advisor, it’s essential to establish a productive working relationship to effectively manage your financial future. Building trust and maintaining effective communication are foundational to this relationship. Being transparent about your financial situation and goals allows your advisor to develop tailored investment strategies and risk management plans that align with your aspirations.

To make the most of your relationship with your financial advisor, consider these practical steps:

You may find that independent financial advisors offer more competitive rates due to varied fee structures, higher advisor accessibility, customized services, distinct regulatory differences, and a focus on client exclusivity compared to larger firms.

Yes, financial advisors are essential for young adults to master early savings importance, budgeting strategies, career financial planning, debt management tips, and investment basics education, setting a solid foundation for financial success.

Working with a financial advisor can affect your taxes through advisor fees, investment taxes, and possible tax deductions. They assist with filing and improve record keeping, which can optimize your financial returns.

Financial advisors’ compensation varies; they may earn through fee structures, commissions, or a mix. High ethical standards and meeting performance benchmarks aid in client retention, avoiding commission conflicts and ensuring compliance.

You’ll find that online financial advisory services offer geographic flexibility, tech integration, and digital literacy advantages. However, they might lag in service customization and client confidentiality compared to face-to-face consultations.

To sum up, whether you choose a financial advisor or an independent financial advisor, it’s important to evaluate your financial needs and goals. Both types of advisors are regulated in NZ to guarantee they meet stringent standards, but their affiliations might influence their recommendations.

Always ask the right questions and thoroughly vet potential advisors. Building a transparent, communicative relationship will help you make the most of their expertise to achieve your financial objectives.